Address

511 N Mead St.

St Johns, MI 48879

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Domestic industry wants stronger tariffs as subsidies have not done enough to ward off Chinese competition

A flood of Chinese-produced solar panels is driving prices to record lows in the US, a boon for renewable energy developers but a threat to solar manufacturers trying to create a domestic supply chain for the country’s fastest-growing source of electricity generation.

China, the dominant solar equipment supplier, doubled production capacity last year to more than 1tn watts and now produces nearly three times more panels than global demand, according to the International Energy Agency and Wood Mackenzie. Global prices for panels have fallen 50 per cent in the past year to as low as 10 cents a watt.

The supply glut has enticed US power companies to favour imports over more expensive domestic panels as they build new solar generating complexes. In response, North American manufacturers say they are pulling back on expansion plans despite lucrative incentives available under the Inflation Reduction Act, the landmark US climate law.

“The market is crap,” said Martin Pochtaruk, president of Heliene, a Canadian solar-panel maker. He said his company delayed plans to add a 500-megawatt assembly line to its solar panel factory in Minnesota. “We don’t want to bite something we cannot chew.”

Last month CubicPV, a Bill Gates-backed manufacturer of wafers for solar panels, scrapped plans to build a 10GW US factory announced in December 2022, citing a “dramatic collapse” in prices.

Mark Widmar, chief executive of First Solar, the largest US solar manufacturer, warned at a Senate finance committee hearing on Tuesday of the country becoming a “de facto extension of China’s Belt and Road Initiative”.

After the IRA’s passage, First Solar announced new factories in Alabama and Louisiana. “[China] does not want the US to have its own domestic industry . . . It’s a pretty dire situation,” Widmar told the Financial Times.

The US puts a 14 per cent tariff on solar component imports from most countries. A separate 25 per cent applies to goods made from China, which Washington imposed citing Beijing’s “discriminatory” trade practices, along with anti-dumping and countervailing duties on Chinese solar panels that exceed 200 per cent.

Solar shipments from south-east Asia were also subject to anti-dumping and countervailing duties after the US commerce department last summer found that five Chinese solar companies were setting up factories in the region to circumvent US tariffs. But the Biden administration issued a moratorium on the duties to last until June.

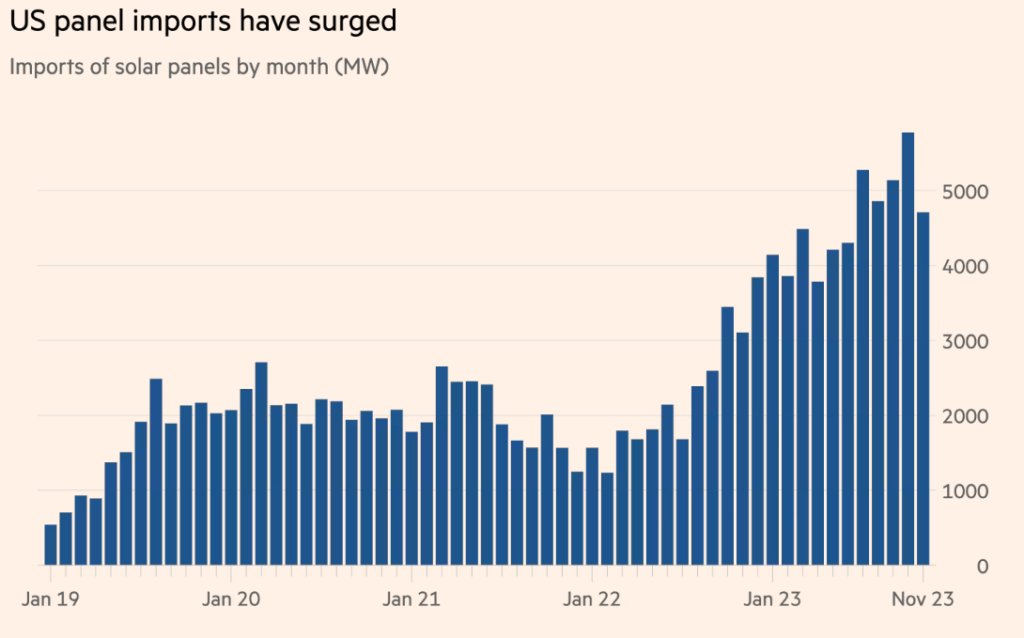

Most of the solar panels imported into the United States come from Southeast Asia, where exports are still far cheaper than similar products made in the United States, even after taking into account tariffs and IRA subsidies. The clean energy research organization said that the United States imported 50 gigawatts of solar panels between January and November 2023, a record high.

The “fate of American solar manufacturers is sealed.” He expects that solar manufacturing commitments, which have accumulated more than 115 gigawatts since President Biden signed the IRA, will be canceled and delayed.

It estimates that by the end of 2024, the cost of solar cells and modules made in the United States will be 18.5 cents per watt, while the cost of Southeast Asian products is 15.6 cents.

“IRA subsidies are very generous, but they are still not enough to compete with cheap imports,” Lescano said, adding that “new protectionist measures” are needed to make American manufacturing more competitive.